GBX-The Crypto Harbour.

The Gibraltar Stock Exchange

The main base of the Gibraltar Stock Exchange is the rapid management of quotes, regardless of the product you choose, as well as the costs that are even lower than those registered in Luxembourg and Switzerland.

The Gibraltar Stock Exchange is headed by Marcus Killick, who led the Gibraltar Financial Services Commission for eleven years, a position he left last February after assuming various responsibilities in the financial sector of the Isle of Man and the islands. Cayman

In addition to this financial instrument, the creation of the Chamber of Commerce and the creation of the investment bank of Gibraltar with 19 million euros of public capital are the first impulses for the financial sector, which intends the government of Picardo. This company will replace Barclays and offer retail services as a differentiating element.

GSX: Gibraltar Stock Exchange

The Gibraltar Stock Exchange (GSX) team, the parent company of GBX, had been studying blockchain technology for some time. In November 2015, they began planning the Crypto Securities Exchange. In mid-2016, the GSX agreed to include one of the world's first Bitcoin Asset-Backed Securities (ABSs) in its regulated core market.

Soon after, the team focused on the emerging world of token sales. It was a market that quickly realized that it lacked clear rules and practices, investor protection, and sufficient litigation to investigate the claims of issuers. In his experience, the market was lacking the government. Without them, this promising sector would never attract sustainable institutional investment or the kind of resources needed for long-term growth.

The need for a clear and professional kind of structure is what GSX has seen, the understanding that now is the best opportunity to contribute and for that it has founded a new subsidiary: the GBX.

His plans, however, go far beyond creating a chip sales platform and exchanging cryptocurrencies. The GSX GROUP intends to build a complete fintech ecosystem that provides all the services and support that issuers, entrepreneurs and investors need in a transparent and regulated framework.

So, how does it work?

1. The role of Gibraltar as jurisdiction is very important.

Gibraltar is a great support for blockchain companies. In October 2017, after a lengthy period of consultation, the Government of Gibraltar published the Distributed Accounting Technology ("DLTRF") legal framework. From 1 January 2018 it is in force. It's a non-prescriptive, rules-based regulatory format that gives companies the flexibility they need to work with new technology without relying on robust standards.

The DLTRF standard recognizes some very important issues that others could not understand in the past. It is not possible to regulate the crypto currencies themselves, but it is possible and reasonable to create standards for individuals and companies acting on behalf of a third party.

The creation of this framework means that the Government of Gibraltar is taking measures to protect investors by ensuring that the companies operating in this area are legally appropriate and appropriate.

Therefore, GBX is fully compatible with DLTRF. It intends to be the first exchange under the supervision of the regulator of Gibraltar and to receive a permit from the regime.

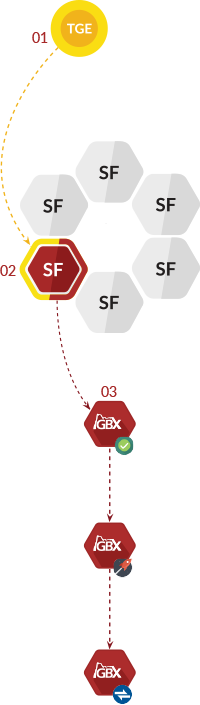

2. The most important thing to understand is the GBX listing process.

GBX is conducting a clear listing process to ensure that candidates on the list follow its rules.

First, a project must name a sponsorship company. The sponsoring companies are organizations that have been licensed by GBX to bring lists to market. They ensure that applicants on the list are not limited to praising the rules, but are actively adhering to the letter and spirit of the rules.

These sponsors ensure that a project is eligible to launch a token sale and list in GBX, provide compliance advice, and work on a project to complete and submit your application. The sponsoring companies also participate in a staking mechanism. You need to have some of the tokens they bring to market.

After the admittance, the sponsoring companies are also responsible for ensuring that the projects comply with their current obligations, most of which are related to the disclosure of information.

It can be said that the sponsors support the initiatives that lead to the market, and their reputation in the market is at stake.

All of this should help GBX projects to act in accordance with a higher standard of business practice and make a sincere effort to achieve this.

3. The role of the carrier companies of GBX is essential to ensure the well-being of the market.

Therefore, any company wishing to become a GBX sponsor must demonstrate the quality of its management team and solid experience in the blockchain.

An important point to consider is the expectations the GBX will have on token buyers.

It is important that the sales of tokens published in GBX and the projects behind them are of a higher standard. We are working to ensure that the products we offer are of the highest quality, but it is also true that the issuers and the GBX itself have some expectations as to who buys the tokens.

The Know Your Customer or "KYC" and anti-money laundering (AML) process is implemented in GBX. In the world in general, we proved in 2017 that the source of funds was not necessarily a problem, but from now on, GBX symbolic buyers must prove who they are and where their funds come from.

For many projects, anonymity was not a problem while the ICO itself was raising funds. Later, many of these projects are in trouble when it comes to daily operational financial relationships. Many banks will not do business with them because they themselves can not prove the source of the funds and because many of the people they sold tokens to are anonymous.

Just as GBX expects transparency from the projects that start selling tokens, buyers are also demanding transparency. GBX intends to provide the best service to both parts of the market.

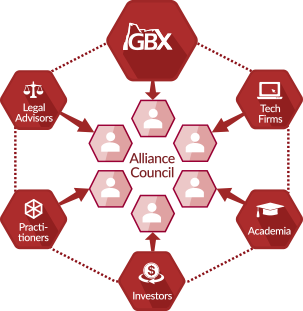

4. The structure and processes of GBX are GBX Alliance and GBX Alliance Council.

GBX expects control and transparency from the market participants, but also from itself.

The GBX Alliance is a membership body made up of leading thinkers, lawyers and professionals throughout the blockchain industry. Members are invited by the GBX leadership to ensure that the exchange reflects the best thoughts and practices, and that the GBX proposal never weakens or undercuts the needs of the participants.

The importance of the GBX Alliance for the configuration of government and GBX rules is underlined by the election of members of the GBX Alliance Council. The GBX Alliance Council will advise the GBX directly and contribute to its decision-making and ethos development.

What has been published so far describes the most important aspects of how the GBX works. The Gibraltar Stock Exchange and the GSX Group in general also participate with a variety of other initiatives in the Blockchain community.

For example: GSX launched the Blockchain Innovation Center (BIC), a center for the development of new technologies that helps bring people together with ideas for new projects and, if necessary, finance them. He has also joined the Ethereum Enterprise Alliance and Hyperledger, where he can interact with a variety of world leaders in the development of blockchain technology.

GBX is preparing to deliver best practices in both its operations and ideas, in a regulated environment that raises standards for the industry as a whole.

Website: https://gbx.gi

Medium Blog: https://medium.com/@Gibraltar.Blockchain.exchange

Facebook: https: // www. facebook.com/GibBlockEx/

Twitter: https://twitter.com/GibBlockEx

Telegram: https://t.me/GBXCommunity

My Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=1118487

Permissions Blog Authors ANDHINI PUTRI

Komentar

Posting Komentar